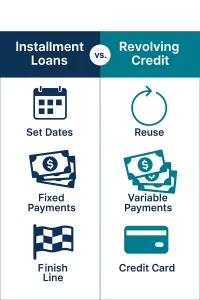

Understanding your borrowing options is crucial when you need quick cash for emergencies or unexpected expenses. Two main types of credit are available to working families: installment loans and revolving credit.

Today, we’re breaking down installment loans vs. revolving credit so you can decide which option fits your financial situation best.

What Are Installment Loans?

Installment loans give you a lump sum of money upfront that you pay back in fixed, equal payments over a set time period. Think of it like financing a car—you get the money immediately but make regular monthly payments until it’s completely paid off.

Common Types of Installment Loans

- Car title loans (like those offered by Freedom Title Loans)

- Personal loans from banks or credit unions

- Mortgages for home purchases

- Student loans for education expenses

- Auto loans from dealerships

How Installment Loans Work

With an installment loan, you receive all the money at once. Your monthly payment stays exactly the same throughout the loan term. Interest is calculated on the original loan amount and built into your fixed payment, so you know the total cost upfront.

Our title loans in Boise, Idaho work this way—you get your cash immediately when approved, then make predictable monthly payments.

What Is Revolving Credit?

Revolving credit gives you access to a credit line that you can use, pay down, and use again repeatedly. Credit cards are the most common example—you have a spending limit, but you can spend up to that limit, pay some back, and spend again.

Common Types of Revolving Credit

- Credit cards

- Home equity lines of credit (HELOCs)

- Business lines of credit

- Personal lines of credit

How Revolving Credit Works

Your monthly payment changes based on how much you owe. If you have a $5,000 credit card limit and use $2,000, your minimum payment is based on that $2,000 balance. Interest is charged monthly on your outstanding balance.

Recent government data reveals important trends. Federal Reserve data shows revolving credit growth at 7% annually while installment loans grew only 3.3%. This means more people are using credit cards than getting installment loans.

Quick Comparison: Installment vs. Revolving Credit

| Feature | Installment Loans | Revolving Credit |

| Payment Amount | Same every month | Changes based on balance |

| Interest | Fixed rate, built into payment | Changes monthly on what you owe |

| End Date | Set payoff date | No set end date |

| Access to Money | Get all money at once | Use up to your limit anytime |

| Credit Check | Often required | Usually required |

| Good For | One-time big expenses | Ongoing small purchases |

Pros and Cons of Installment Loans

Pros of Installment Loans

- Predictable payments that fit your budget every month

- Fixed interest rates so your payment never changes

- Clear end date so you know exactly when you’ll be debt-free

- Higher loan amounts for larger expenses (up to $25,000 with Freedom Title)

- No credit checks required with title loans

Cons of Installment Loans

- You receive all money at once (can’t borrow more without a new loan)

- Less flexibility than revolving credit

- Early payoff may include penalties with some lenders

Pros and Cons of Revolving Credit

Pros of Revolving Credit

- Flexibility to use funds as needed

- Only pay interest on what you use

- Can reuse credit as you pay it down

- Good for ongoing or unpredictable expenses

Cons of Revolving Credit

- Variable payments that can be hard to budget

- High interest rates (often 18-29% APR for credit cards)

- No set end date for payoff

- Easy to overspend and get trapped in debt

- Minimum payments can stretch debt for years

Real Cost Examples

Many families face money challenges today. New survey data shows that over one-third of American families struggle with expenses like food, housing, and medical bills. This explains why understanding loan costs is so important.

$5,000 Loan Cost Comparison

| Loan Type | Monthly Payment | Time to Pay Off | Total Interest Paid | Total Cost |

| Title Loan (Installment) | $208 | 24 months | $992 | $5,992 |

| Credit Card (Revolving) | $150 minimum | 48 months* | $2,200 | $7,200 |

| Credit Card (Fixed $208) | $208 | 26 months | $1,408 | $6,408 |

*Paying only minimum payments

*Examples use typical rates for illustration

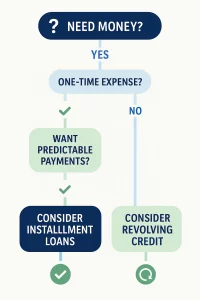

Which Option Is Right for You?

Choose Installment Loans When You:

- Need a specific amount for a one-time expense

- Want predictable monthly payments

- Prefer knowing exactly when your debt will be paid off

- Have a clear plan for using the funds (medical bills, home repairs, etc.)

For Idaho families, our installment loans in Nampa provide financial relief without payment uncertainty.

Choose Revolving Credit When You:

- Need ongoing access to funds for various expenses

- Want flexibility in how much you borrow and when

- Can discipline yourself to pay more than minimum payments

- Have irregular income but steady expenses

Installment Loans with Freedom Title

If you’re considering an installment loan, Freedom Title offers reliable car title loans in Boise and Nampa. Here’s how it works:

Easy Application Process

You can apply online, over the phone, or in person at our convenient locations:

- Boise office: 6927 West Fairview Avenue

- Nampa office: 421 Caldwell Boulevard, #101

Quick Approval and Funding

- Approval is fast and straightforward, often on the same day

- Get same-day loans in Boise, Idaho when you need cash immediately

- Simple requirements with no lengthy paperwork

Flexible Terms

- Keep driving your vehicle while paying off the loan

- Loan amounts up to $25,000 depending on your vehicle’s value

- No credit checks because we understand past credit problems don’t define your current ability to repay

- Flexible income requirements (we accept disability, unemployment, and retirement income)

Financial experts have studied how different loans impact credit scores. Research shows that revolving credit affects your credit score more than installment loans. This happens because credit cards show lenders how you manage money day by day. For more information on How Installment Loan Repayment Works: Check out our Step-by-Step Guide

Idaho’s Lending Advantages

Idaho offers unique benefits for borrowers seeking installment loans. Unlike many states with restrictive lending laws, Idaho provides reasonable regulations that allow us to offer competitive rates while maintaining consumer protections.

Our Idaho loans are designed to work within this framework, providing maximum benefit to borrowers while meeting all state requirements.

Real Idaho Family Examples

The Martinez Family – Medical Emergency

When their daughter broke her arm, the Martinez family faced $3,200 in medical bills. They chose one of our Idaho title loans in Nampa rather than putting the expense on credit cards.

With fixed monthly payments of $147 for 24 months, they knew exactly what to budget and avoided the risk of minimum payments that could stretch the debt for years.

The Johnson Situation – Home Repair

After a pipe burst in their Boise home, the Johnsons needed $2,800 for emergency repairs. Our same-day loans in Boise, Idaho provided cash within hours, with a clear repayment plan that didn’t disrupt their monthly budget.

Making Your Decision

The choice between installment loans and revolving credit depends on your specific situation, financial discipline, and goals. Ask yourself:

- Do I need a specific amount for a one-time expense? → Consider installment loans

- Do I need ongoing access to funds? → Revolving credit might work better

- Do I want predictable monthly payments? → Installment loans provide this certainty

- Am I disciplined about paying more than minimums? → Important for revolving credit success

Get Started with Freedom Title Today

If you’ve determined that an installment loan might be right for your financial needs, we’re here to help. Our process is designed to be straightforward and respectful of your time and situation.

Whether you’re dealing with unexpected medical bills, home repairs, or other financial challenges, our team understands you need solutions, not complicated financial products that create more stress.

Ready to explore your options? Contact Freedom Title today to discuss how we can help you get the financial relief you deserve while keeping your wheels rolling and your budget on track.

Visit our FAQ page to learn more about our process, or stop by one of our convenient Idaho locations. We’re not just here to provide loans—we’re here to provide financial relief that works for real people in real situations.